Is Social Security Taxable Income 2021 : 2020 Year-End Tax Letter for Individuals | BSB / Social security income limits can be confusing, and the stakes are high.

Is Social Security Taxable Income 2021 : 2020 Year-End Tax Letter for Individuals | BSB / Social security income limits can be confusing, and the stakes are high.. Your provisional income is equal to your adjusted gross income (agi) plus nontaxable interest (think municipal bonds), plus 50% of your ss benefits. Social security benefits are factored into the majority of american retirement plans. Calculating taxable social security benefits. The 2021 rates are effective jan. But that money is added in to their other income.

For 2021, the estimated average monthly social security check is $1,543, which comes to $18,516 per year. The 2021 rates are effective jan. This income will be taxed at up to 50% if within the. In 2020, rosie filed for social security; Find out whether your income from social security can be taxed in this howstuffworks article.

But is social security income taxable?

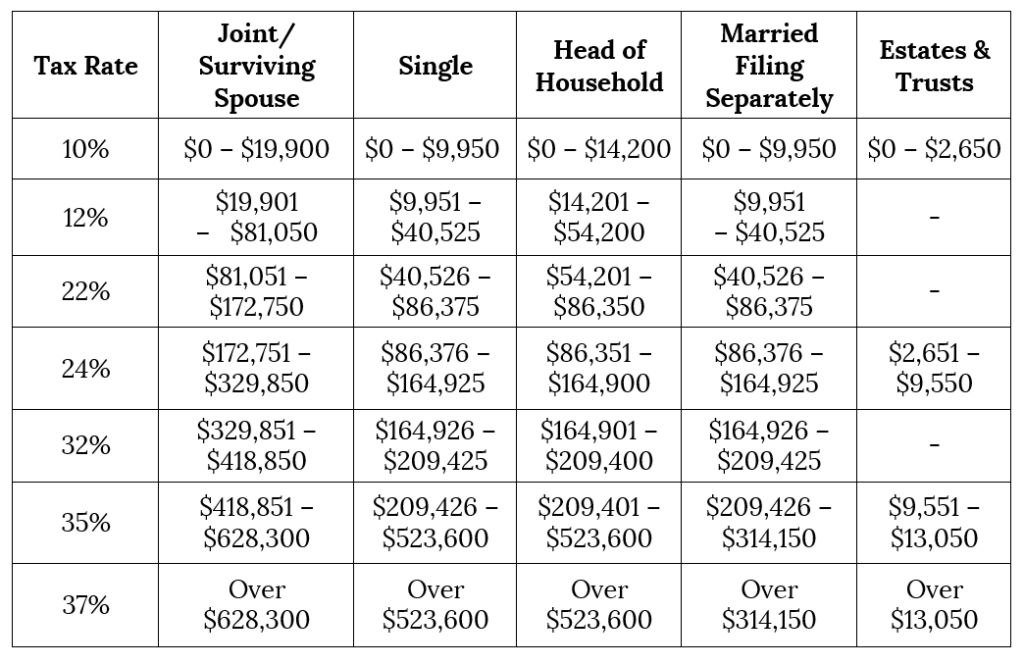

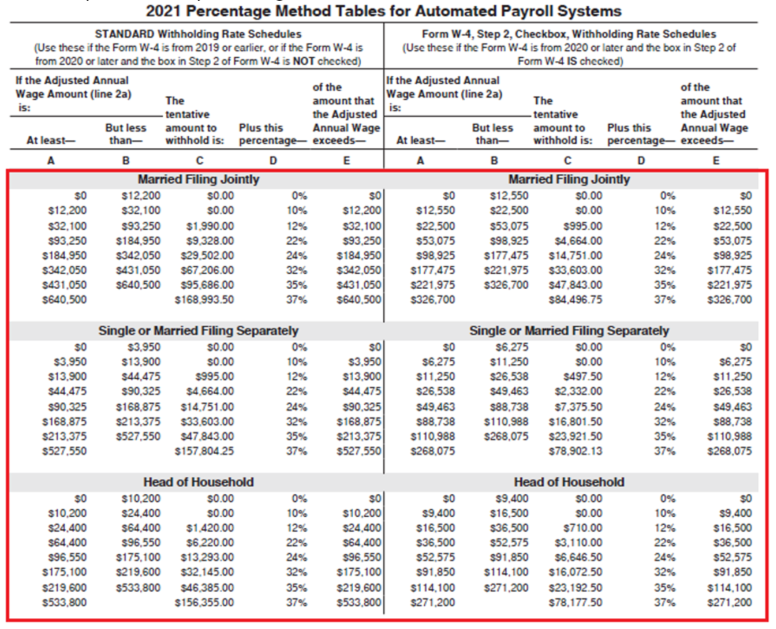

The portion of benefits that are taxable depends on the taxpayer's income and filing status. Social security disability insurance (ssdi) is a social insurance program funded by payroll taxes meant to help you if you become disabled. Those payments are not taxable. Once the combined income amount reaches $32,000 up to $44,000, then half of your social security benefits will be considered taxable income. One of the most popular questions we get from social security applicants and new beneficiaries is whether social security income is taxable. Up to 50% of social security income is taxable for individuals with a total gross income including social security of at least $25,000, or couples filing jointly with a combined gross. But many retirees receive over $3,000 per month those who have salaries larger than the taxable maximum do not pay social security taxes on that income or have those earnings factored into their future. Although the social security tax rate generally does not change from year to year, the social security taxable wage base does. If your only income is social security, it's probably not taxable. Is social security income taxable? Generally, yes your social security benefits are taxable. When you're planning your retirement, you have look at all of your income streams during retirement and the living expenses you'll be expecting. Half your social security benefit.

The social security administration estimates that about 56 percent of social security recipients owe income taxes on their benefits. Your provisional income is equal to your adjusted gross income (agi) plus nontaxable interest (think municipal bonds), plus 50% of your ss benefits. Half your social security benefit. Taxes being paid by workers at present aren't saved for their own. The portion of benefits that are taxable depends on the taxpayer's income and filing status.

All of these forms of income are typically taxable in the year you receive them.

Social security income does not include supplemental security income payments; The limit is $142,800 for 2021, meaning any income you make over $142,800 will not be subject to social security tax. Utah includes social security benefits in taxable income but allows a tax credit for a portion of the benefits subject to tax. But if you have income beyond social security, you might have to start paying taxes on those checks every month. They don't include supplemental security income payments, which aren't taxable. So normally, all income from whatever source is taxable. 85% of your social security income can be taxed. In 2020, rosie filed for social security; Amelia josephson mar 10, 2021. You should also be checking on the taxes you're expected to pay, specifically taxes on your social security income. Get our taxable social security benefits calculator. Taxes being paid by workers at present aren't saved for their own. Generally, the formula for total income for this purpose is:

$10,000 income in excess of limit x 50% ($1 reduction for every $2 over limit) › get more: Amelia josephson mar 10, 2021. This could result in a if your income exceeds certain thresholds, then social security will withhold benefits until you reach the taxable wage base is the maximum amount of earned income that employees must pay social. Read this to understand the rules for working while on social security. Get our taxable social security benefits calculator.

When you're planning your retirement, you have look at all of your income streams during retirement and the living expenses you'll be expecting.

Although the social security tax rate generally does not change from year to year, the social security taxable wage base does. But that money is added in to their other income. That's well below the minimum amount for taxability at the federal level. Social security disability insurance (ssdi) is a social insurance program funded by payroll taxes meant to help you if you become disabled. Generally, yes your social security benefits are taxable. When is social security income taxable? Those payments are not taxable. Throughout the year she received $1,667 in benefits every month. That's because determining the taxable portion of your social security benefits requires a few additional calculations that hinge upon how much money you. Given these factors, the maximum amount an. These are the rules for 2021. Read on to learn more about social security tax. The social security maximum taxable income for 2021 is $142,800. there is no maximum taxable income for medicare withholding.

Komentar

Posting Komentar